You are here:Chùa Bình Long – Phan Thiết > block

Bitcoin Price in India: A Comprehensive Analysis

Chùa Bình Long – Phan Thiết2024-09-22 01:26:01【block】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has gained significant popularity as a digital currency, and its price has airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has gained significant popularity as a digital currency, and its price has

In recent years, Bitcoin has gained significant popularity as a digital currency, and its price has been fluctuating constantly. India, being one of the fastest-growing economies in the world, has also witnessed a surge in the interest for Bitcoin. This article aims to provide a comprehensive analysis of the Bitcoin price in India, including its current status, factors influencing it, and future prospects.

Bitcoin Price in India: Current Status

As of now, the Bitcoin price in India is hovering around Rs. 50,000 per coin. However, it is essential to note that this price is subject to frequent changes due to various factors. The price of Bitcoin in India is generally higher than in other countries, primarily due to the demand-supply dynamics and regulatory environment.

Factors Influencing Bitcoin Price in India

1. Demand and Supply: The demand for Bitcoin in India has been on the rise, driven by investors and enthusiasts. The supply of Bitcoin is limited, as it is a deflationary asset. This scarcity, coupled with increasing demand, has led to a higher price of Bitcoin in India.

2. Regulatory Environment: The regulatory environment in India has been a significant factor influencing the Bitcoin price. In April 2018, the Reserve Bank of India (RBI) banned banks from dealing with cryptocurrency exchanges. This move led to a temporary decline in the Bitcoin price in India. However, the situation has improved since then, and the price has started to recover.

3. Global Market Trends: The global market trends also play a crucial role in determining the Bitcoin price in India. Since Bitcoin is a global currency, its price is influenced by various factors, including geopolitical events, regulatory changes, and technological advancements.

4. Local Economic Factors: The economic conditions in India, such as inflation, interest rates, and currency exchange rates, also impact the Bitcoin price. For instance, during periods of high inflation, investors may turn to Bitcoin as a hedge against inflation, leading to an increase in its price.

Future Prospects of Bitcoin Price in India

The future of Bitcoin price in India remains uncertain, but several factors suggest that it may continue to rise in the long term:

1. Increasing Adoption: As more people in India become aware of Bitcoin and its potential, its adoption is expected to increase. This, in turn, may lead to a higher demand for Bitcoin, driving up its price.

2. Technological Advancements: The ongoing technological advancements in the blockchain and cryptocurrency space may contribute to the growth of Bitcoin. This includes improvements in scalability, security, and user-friendliness.

3. Regulatory Clarity: With the government and regulatory authorities working towards providing clarity on the regulatory framework for cryptocurrencies, the Bitcoin price in India may stabilize and even rise.

4. Alternative Investment: As traditional investment options become less attractive due to factors like low interest rates and market volatility, Bitcoin may emerge as an alternative investment, leading to increased demand and higher prices.

In conclusion, the Bitcoin price in India has been fluctuating constantly, influenced by various factors. While the current price is around Rs. 50,000 per coin, the future prospects seem promising. As more people in India become aware of Bitcoin and its potential, its price may continue to rise. However, it is crucial to keep an eye on the regulatory environment and global market trends to make informed decisions regarding Bitcoin investments.

This article address:https://www.binhlongphanthiet.com/blog/05b61099384.html

Like!(88521)

Related Posts

- What is Causing Bitcoin Cash to Spike?

- Bitcoin: A Peer-to-Peer Electronic Cash System Date

- Bitcoin Price Analysis: Insights from Gareth Soloway

- Bitcoin Price One Million: A Dream or Reality?

- Does Mining Bitcoin Damage Your Computer?

- Can I Buy Bitcoin Online with a Credit Card?

- Can You Spend Bitcoin on Cash App?

- Samourai Wallet Bitcoin: A Secure and Privacy-Focused Cryptocurrency Experience

- The Richest Bitcoin Wallets: A Closer Look at the Wealthiest Bitcoin Holders

- Bitcoin Share Price in India: A Volatile yet Promising Investment Landscape

Popular

Recent

Bitcoin vs Gold Price Chart: A Comprehensive Analysis

Bitcoin Mining Management Software Open Source: Streamlining the Mining Process

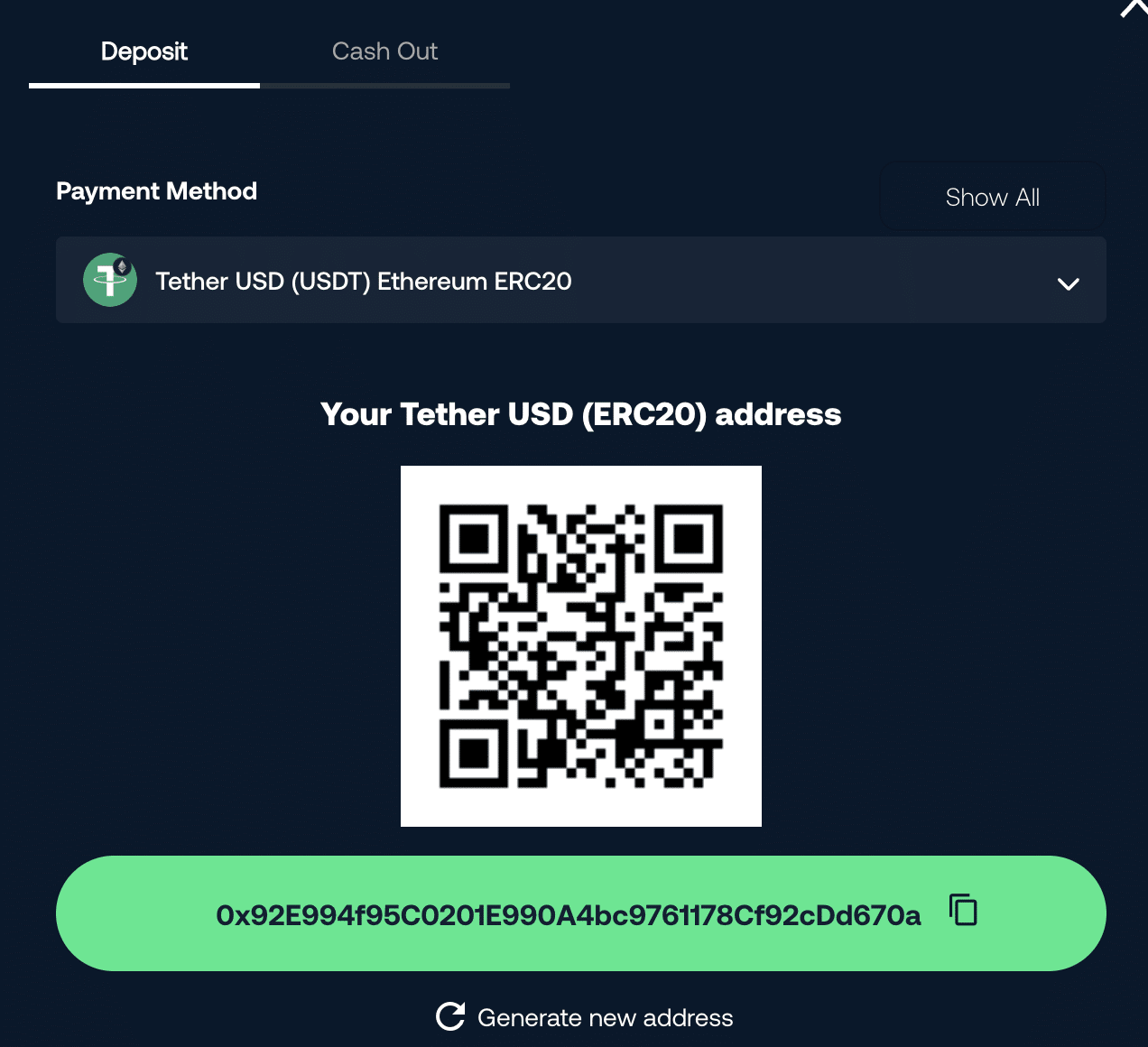

How to See My Wallet Address on Binance: A Step-by-Step Guide

The Bitcoin Wallet: A Gateway to the Cryptocurrency World

Buying Kin via Binance: A Comprehensive Guide

Can I Sell Bitcoin on Foreign Exchanges?

Buy Bitcoin Cash Fast: A Comprehensive Guide to Quick and Secure Transactions

Mobile Bitcoin Wallet PayPal: A Secure and Convenient Solution for Digital Transactions

links

- Binance Withdrawal Takes Forever: A Comprehensive Guide to Solving the Problem

- Binance USDT and XTZ: A Comprehensive Guide to Trading and Investment

- How to Connect Binance to Metamask Wallet: A Step-by-Step Guide

- The Rise of XXX/BTC on Binance: A Game-Changing Cryptocurrency Pair

- How to Send to Bitcoin Wallet on Cash App: A Step-by-Step Guide

- Bitcoin Wallet Millions: A Comprehensive Guide to Managing Your Cryptocurrency

- How to Block Bitcoin Mining in Browser: Protect Your Privacy and Save Resources

- Why Does Mining Bitcoin Work?

- Segwit2x and Bitcoin Price: The Impact of the Controversial Fork

- **Web Hosting Bitcoin Mining: A Lucrative Combination for Tech-Savvy Investors